The loan will be no more than 250000 at a preferential rate of 3 for the first two years. Students should never have to waste time worrying about their financial situation.

Can Foreigners Get A Loan In Germany

Before 2010 Germany used to be a developing country with regard to microfinancing according to Jörg Schoolmann from the German Microfinance Institute which advises microcredit lenders.

. In Germany there are generous provisions for students including a range of state-financed grants and private loans. In 2018 the average mortgage rate was 185 according to data from Statista. 40 N26 Bank was founded in 2013 and launched its first product in 2015.

Find out how to apply for a quick loan in Germany to help cover a cash shortfall and get you through to your next payday. Known as Rahmenkredit but with a difference that it has a fixed monthly payment compared to installment loans with a variable monthly payment. The prices indicate the minimum interest rate that you will pay the actual interest rate depends on your individual loan and your credit score.

Thus the only way youre getting this loan is if you earn at least 823863 per month. KfW fast track loan for the mid-sized companies. Also known as Ratenkredit which is a personal loan.

The Quick Loan Program will provide fully-guaranteed instant loans of up to EUR 800000 to eligible businesses. N26 Bank provides current accounts payment cards consumer loans to private individuals freelancers and self-employed professionals. Hinterhof 10179 Berlinfor a loan of 1000 at nominal interest rate of 199 pa.

And effective interest rate of 201 pa. Very short-term loans Sometimes you just need a short-term loan in Germany to make both ends meet after an exceptional expense like paying a deposit for example. Remember most banks will only give you a loan if the repayment rate is higher than 25 of your income.

The table above shows essential details of selected consumer loans products offered to retail customers by the banks in Germany. The example shown refers to loans provided by N26 Bank GmbH at Rungestr. Traditionally consumer lending in Germany has been dominated by credit banks savings banks and credit cooperatives as they grant the vast majority of loans.

N26 Bank GmbH is a new innovative German bank focused on offering retailbanking products and services online. We would however sound a note of caution with this type of loan as they tend to have quite a number of fees connected. On April 6 Germany introduced a fully guaranteed loan program to support small businesses after an earlier partial government guarantee did not achieve its intended results.

This loan is 100 secured by the German Federal Government guarantee. This type of loan is more attractive when interest rates are higher. A combination of the low default rate on German mortgages with historically low Euribor rates led German mortgage rates to be among the lowest in the world.

In Great Britain this form of bridging financing is used successfully since some time now and is accepted gratefully by people who want to borrow a smaller amount until the next salary payment. It is highly advisable to understand the small print. The Micro-loan Fund Germany is a well-established instrument for the allocation of micro-loans in response to the financing needs of small companies which would otherwise have no access to borrowing.

Federal state public loans Alongside the loans offered by the KfW each German federal state has its own development bank which provides loans of up to 10 million euros to small and medium-sized enterprises SMEs. 61 rows See the following list for an overview of various personal loan providers in Germany. Although it is usually advised to turn to friends and family for such cases you can also use such services that can help out if you need a bit of cash and fast.

Total cost of the loan. This article provides all the basic information you need to know about getting a credit loan in German the types of loans in Germany the requirements of getting a loan and other alternative ways to obtain a loan even if you have no credit score in Germany. This type of loan is still popular in Germany and is promoted strongly by banks and building societies.

So lets get to know these essential services in more detail. To be reimbursed over the period of 60 months. The Starteo Loan for companies that have been operating for less than four years.

The consumer loans terms vary from 6 month to 10 years 120 monthsThe effective borrowing rates are within the range 149 - 1399. The short-term loan eg. Types of loans for Expats in Germany.

It may be a small loan to furnish your new apartment after moving to Germany or a big loan to buy a car or a house in Germany. Mortgage application fees are typically 12 of. Mind you this is a hypothesis most banks will require you take insurances in addition to the loan which will cost much more.

30 days The provider Vexcash has brought the new form of short-term loan to Germany. This ensures that poorer students dont slip through the net and it can also help international students who need some extra help. The Entrepreneur Loan Unternehmerkredit finances up to 100 of eligible costs up to a maximum of 25 million euros.

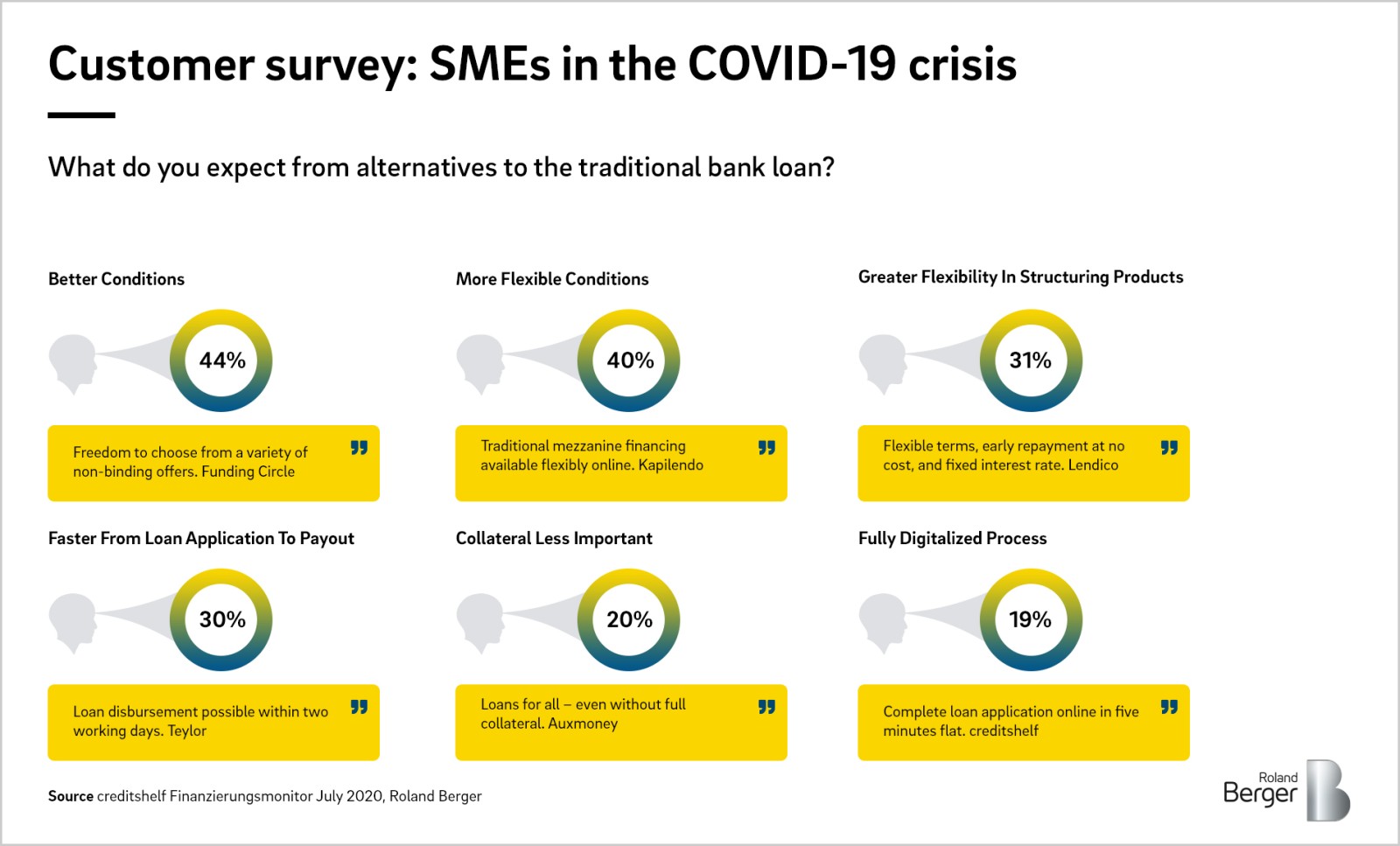

We recommend to compare. However digital financing options provided by online players in the fintech space are becoming increasingly influential especially following the pandemic-induced digitalisation push in Germany. Currency effective rate per annum and loan term in months.

The KfW Kreditanstalt für Wiederaufbau offers a fast track loan for the companies with more than 10 employees. For small to medium sized enterprises SME and the self employed there is The Participation Fund. Mid-sized companies can apply for the new KfW fast track loan for investments and running costs as of 15 April 2020.

These are EU backed loans that offer the following. The fund is aimed at small and young start-ups and companies and at persons who are self-employed and pursuing a creative venture.

Federal Ministry Of Finance For Jobs And The Economy Immediate Assistance Programme And Economic Stabilisation Fund

Getting A Loan In Germany As A Foreigner 2021 English Guide

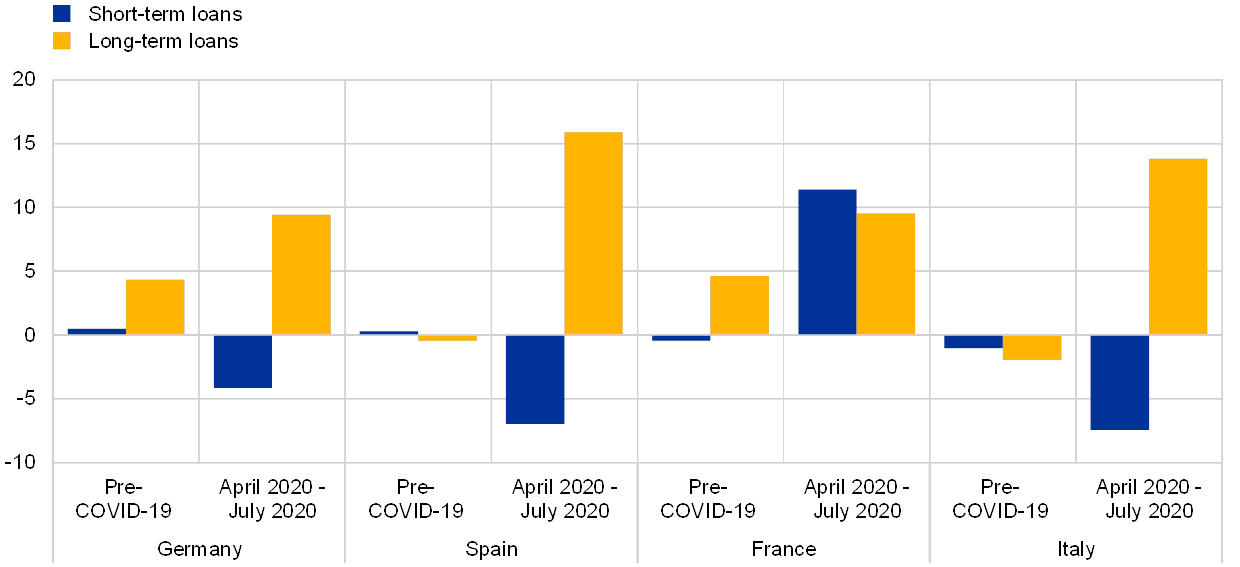

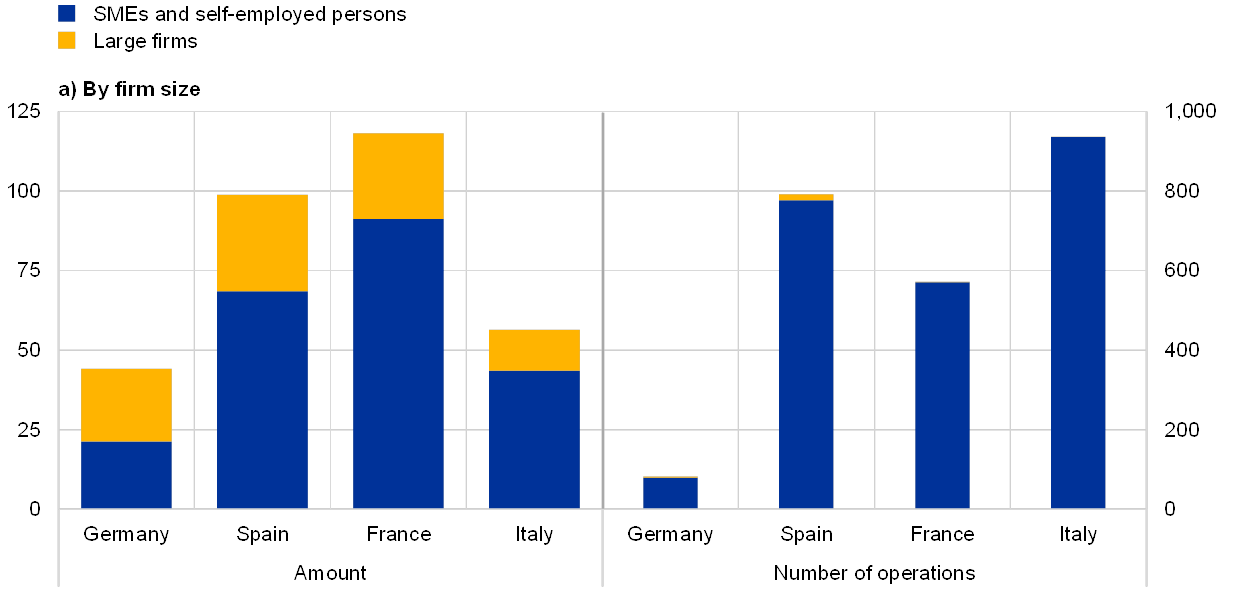

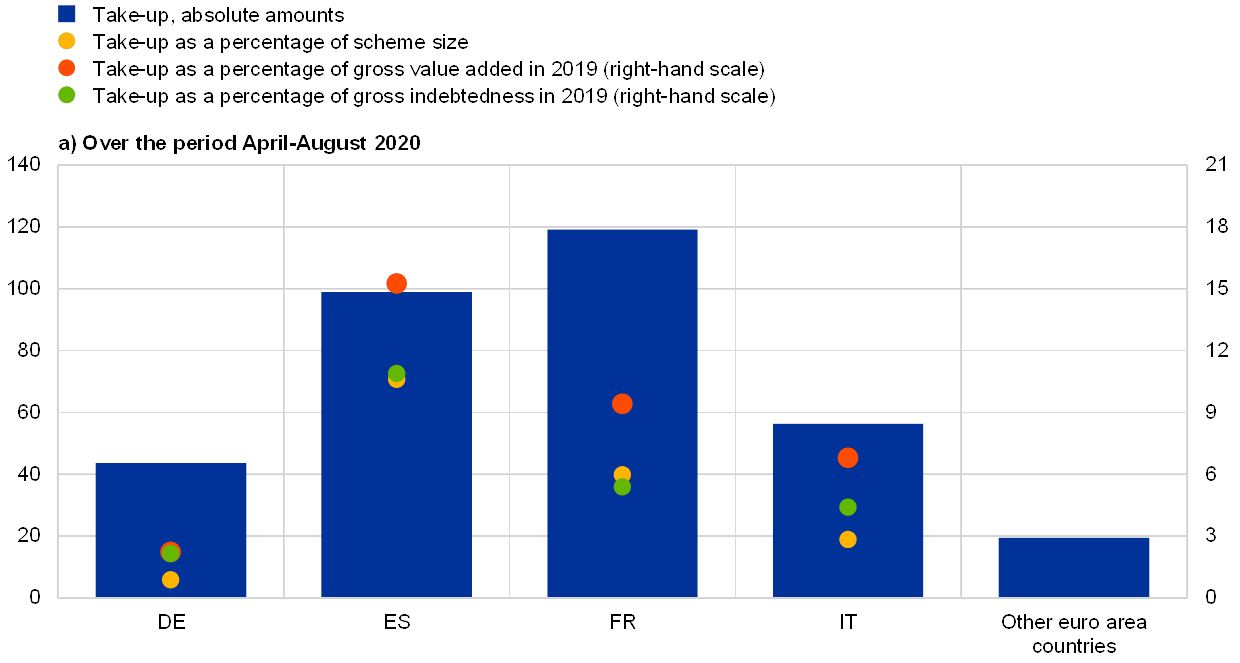

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Bmwi Federal Ministry For Economic Affairs And Energy Financing For Start Ups Company Growth And Innovations

Sme Lending In Transition Opportunities To Develop Future Oriented Business Models Roland Berger

Bafog And Other Student Loans In Germany Expatrio Com

Getting A Loan In Germany As A Foreigner 2021 English Guide

The Complete Guide To German Banks For Expats Expatica

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Getting A Loan In Germany As A Foreigner 2021 English Guide

Best German Bank For English Speakers 2021 Guide

Sme Lending In Transition Opportunities To Develop Future Oriented Business Models Roland Berger

Public Loan Guarantees And Bank Lending In The Covid 19 Period

Getting A Loan In Germany As A Foreigner 2021 English Guide

Smes In Germany 2020 By Sector Statista

Which Personal Loan Or Credit Provider Is The Best In Germany My German Finances

Public Loan Guarantees And Bank Lending In The Covid 19 Period

0 comments:

Post a Comment